Social Security Income Tax Limit 2025 Married Filing

BlogSocial Security Income Tax Limit 2025 Married Filing - Social Security Limit What Counts as Social Security, If you are married and file a joint return with a spouse who's also 65 or older, you'll need to file a return if your combined adjusted gross income is $30,700 or more. Social Security Tax Limit 2025 Married Edee Oralee, Start with your modified agi.

Social Security Limit What Counts as Social Security, If you are married and file a joint return with a spouse who's also 65 or older, you'll need to file a return if your combined adjusted gross income is $30,700 or more.

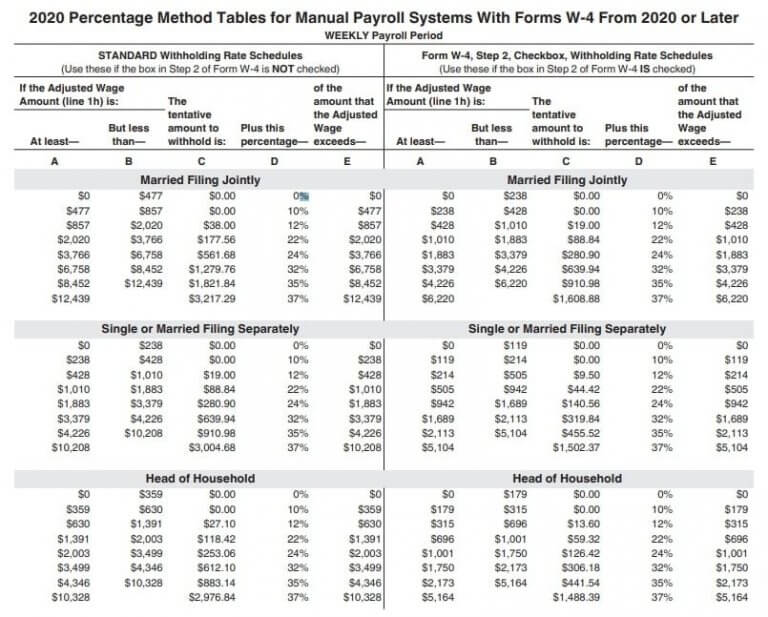

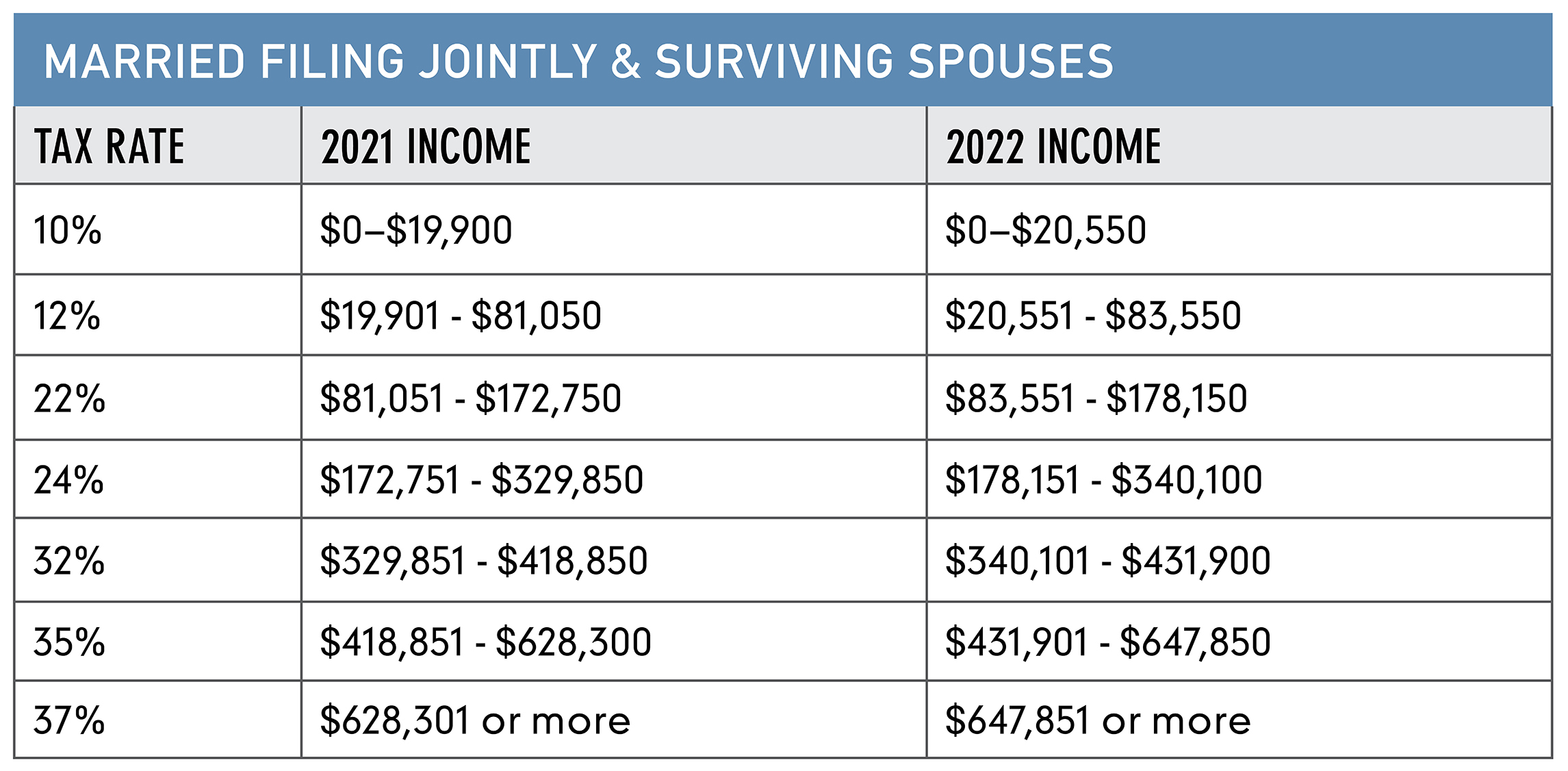

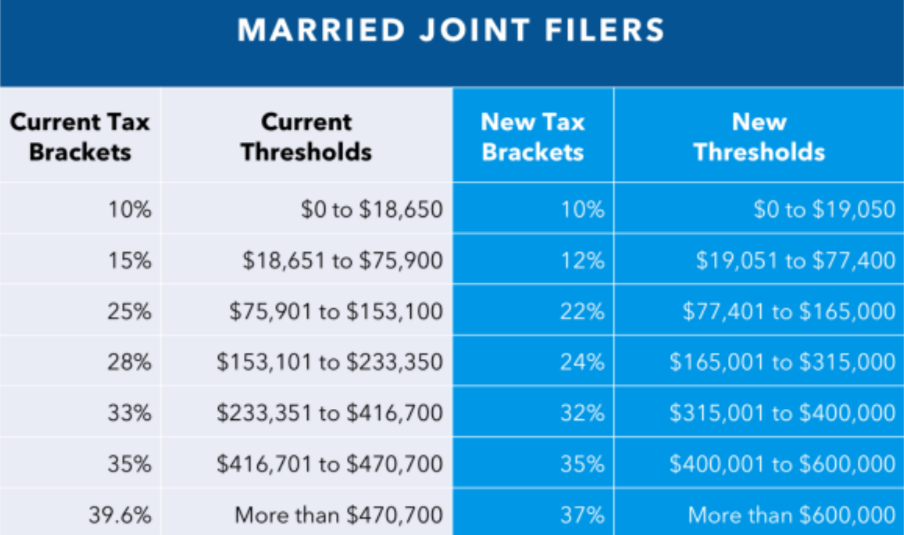

Social Security Tax Limit 2025 Married Filing Hannah Merridie, For example, if you file your taxes as “married filing jointly,” earnings from both spouses are counted together to determine how much you owe in taxes.

Ira Limits 2025 Married Filing Jointly Married Dorie Geralda, So it makes sense to wonder what happens if a spouse earns more than the social security income limit — how does that affect your benefits if you want to file early?

Social Security Tax Limit 2025 Married Filing Emmie Gavrielle, Around 66 per cent of taxpayers out of the over 4 crore filers have opted for the new income tax regime for income tax return (itr) filing.

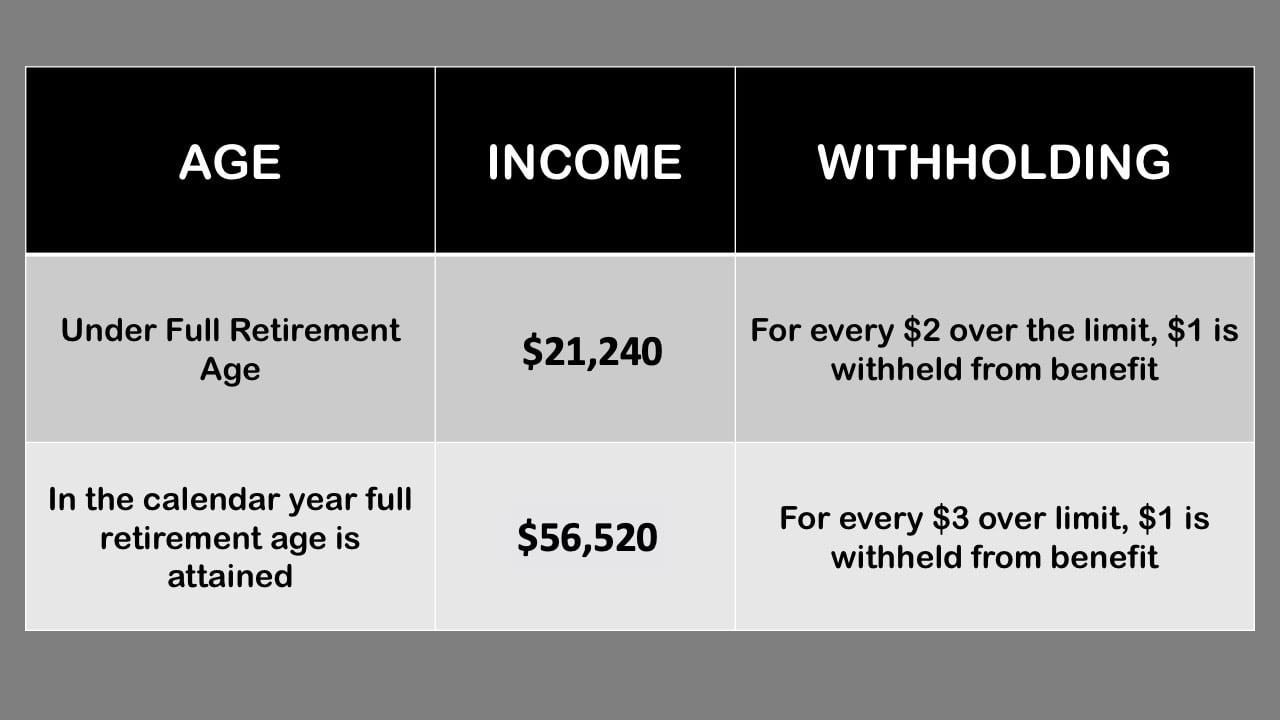

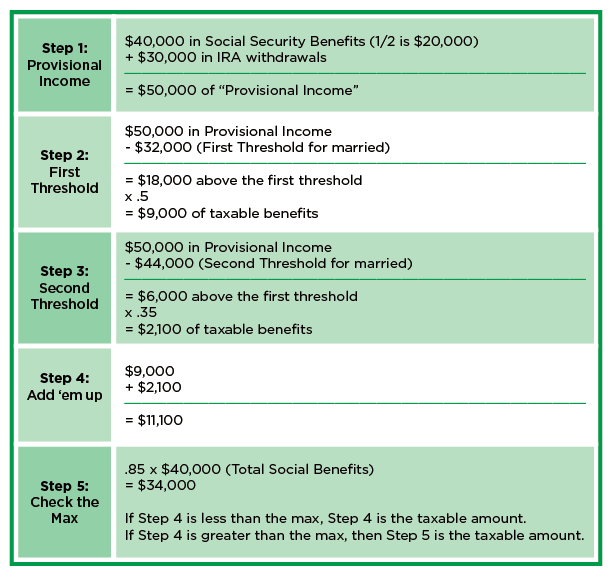

Tax Brackets 2025 Married Filing Jointly Cordi Paulita, If you continue to work while receiving social security, your benefits might be taxed based on your combined income.

Married Filing Jointly Roth Limits 2025 Una Lindsey, This is up from $9,932.40 ($160,200 x 6.2%) in 2025.

401k Limits 2025 Married Filing Jointly Abbye Annissa, If your spouse is under 65 years old, then the threshold amount decreases to $29,200.

Tax Brackets 2025 Married Filing Jointly Daryl Dalenna, So if you earn $168,600 or more, the most.

2025 Roth Ira Contribution Limits Married Filing Separately Leese, Singles and married filing separately:

Social Security Income Tax Limit 2025 Married Filing. Below is a breakdown of the categories. This is up from $9,932.40 ($160,200 x 6.2%) in 2025.

If you continue to work while receiving social security, your benefits might be taxed based on your combined income. If you are married and file a joint return with a spouse who’s also 65 or older, you’ll need to file a return if your combined adjusted gross income is $30,700 or more.